2015-2022 Market CAGR 6%. Granulated into 43 Submarkets

Explosives Trace Detectors (ETD) are a key modality in homeland security, military and public safety. Uses of ETD include air, sea and land transportation security, force protection, law enforcement, CIP and the private sector security.

|

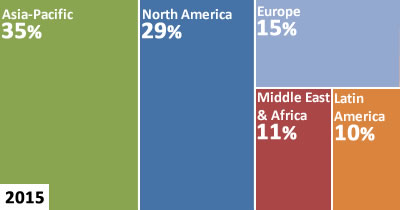

| ETD Market Share [%] by Region – 2015, 2022 |

A comeback of the Explosives Trace Detection (ETD) market is forecasted, generating a solid 2015-2022 CAGR of 6%.

The market growth is driven by the following:

- The 2015-2016 ISIS-inspired and other terror groups attacks across Europe, Middle East and Africa drove governments to overhaul their counter terror explosives screening infrastructure and funding

- The election of Donald Trump as U.S. president promising, throughout his campaign, a tough fight against Islamist extremism terror at home and abroad and to invest in law and order (e.g., "I am the law-and-order candidate"), will boost the federal U.S. ETD-related budgets

- During the past 3 years, explosive-based terror accounted for 56% of over 36,000 worldwide terror attacks

- The projected 2017-2022 growth of Air-Passengers and Air-Cargo CAGR of 5%

- Growth of the Asia-Pacific and GCC airport industry markets

- The need to replace or upgrade thousands of outdated ETD devices with state-of-the-art systems

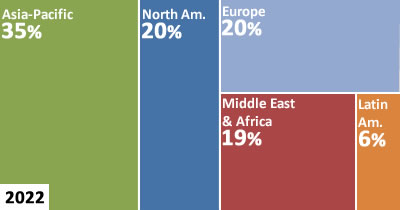

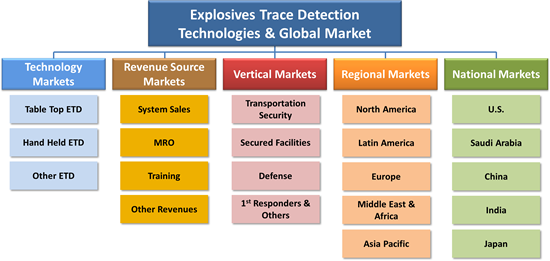

The "Explosives Trace Detection (ETD): Technologies & Global Market – 2017-2022" report examines each dollar spent in the market via 5 orthogonal money trails: regional markets, national markets, vertical markets, technology markets and by revenue sources.

|

Global ETD Market Vectors |

The "Explosives Trace Detection (ETD): Technologies & Global Market – 2017-2022" report, segmented into 43 submarkets offers for each submarket 2015-2016 data and assessments, as well as 2017-2022 forecast and analysis. In 610 pages, 130 tables and 135 figures, the report analyzes and projects the market and technologies from several perspectives, including:

- 5 Vertical markets (transportation security, secured facilities, defense, 1st responders & others)

- 5 National markets (U.S., Saudi Arabia, China, India, Japan)

- 5 Regional markets

- 4 Revenue Sources: sales, MRO, training and other revenue sources

- 3 Product Configurations (hand-held, table-top and other ETDs)

Questions answered in this 2-volume 610-page mega report include:

- What will the ETD market size be in 2017-2022?

- What are the key and pipeline ETD technologies?

- What are the key ETD market trends?

- What are the opportunities to increase your market share?

- What is driving this market?

- What are the inhibitors to your growth?

- What are the risks to your market share?

- Who are the key vendors in this market?

- What are the threats faced by the key vendors?

The report presents:

- 24 Major ETD vendors profiles, products and prices Autoclear US (Formerly Control Screening LLC), Biosensor Applications AB, DetectaChem, LLC, Electronic Sensor Technology, Hitachi, Ltd, ICx Technologies (Flir), Implant Sciences Corp., Ion Applications, Inc., Ketech Defence, Mistral Security, Inc, Morpho Detection Inc., NUCTECH Co. Ltd, Red X Defense, SCANNA MSC Ltd., Scent Detection Technologies, Scintrex Trace, Sibel Ltd, Smiths Detection, Syagen Technology, Thermo Fisher Scientific Inc., Westminster International Ltd.

- Market analysis (e.g., market dynamics, market drivers and inhibitors)

- U.S. government contracts with ETD suppliers (including general terms & conditions, price lists and more): Control Screening LLC, Federal Resources Supply Co., ICx Technologies Inc., Implant Sciences Corp, Laurus Systems Inc., Morpho Detection, Security 20/20 Inc., Security Detection, Smiths Detection, Treasure Electronics, Inc., Veteran Corps of America, Winvale Group.

- Contact info of more than 550 potential ETD customers (authorized air-cargo screening facilities)

- Dozens of current and pipeline ETD technologies including: Ion Mobility Spectroscopy (IMS), ChemiLuminescence (Thermal Energy Analyzers), Electron Capture Detectors (ECD), Surface Acoustic Wave (SAW), Nanotechnology-enabled Technologies for Explosives Detection, Advanced Sample Collection, Dual Sensor ETD Technology, Chemical Warfare and Narcotics Trace Detectors, Receptor-based Technologies, Molecularly Imprinted Polymers, Nano-mechanical Sensors, Electronic Nose, Silica Micro-cantilever, Surface Enhanced Raman Scattering, Protein Coated Carbon Nanotubes, Piezo-resistive Polymer Cantilever, Inkjet Based Wireless ETD Sensor, Amino-silane Coated Nanowires Arrays, Free-surface Microfluidic Control of Surface-Enhanced Raman Spectroscopy, Molecularly Imprinted Polymers, Cantilever Nano Mechanical Sensors, Sensor Array and Neural Network, Temperature-Stepped Desorption, UV-PLF, Non-Contact Explosives Harvesting, Pulsed-Ultraviolet Laser Raman Spectroscopy, Nanowire-Nano-cluster Hybrids, Laser-Induced Breakdown Spectroscopy (LIBS), MEMS-Based Explosive Particle Detection, Remote Particle Stimulation, Laser Vaporization.

- SWOT analysis

- Business opportunities

- Over 1700 airports statistics: each airport segmented by country and its 2016 & 2020 screened items statistics

- Product comparison tables

- Product price lists: including list prices and U.S. government prices of 100’s systems and their consumables

- Competitive analysis & SWOT analysis

- The report includes the following 18 Appendices:

Appendix A: Current Explosives & Narcotics Detection Technologies

Appendix B: Pipeline ETD Technologies

Appendix C: Pipeline ETD Systems by Configuration & Application

Appendix D: ETD Business Opportunities

Appendix E: ETD Products: Prices, Technologies, Detection Capabilities & Vendors Comparison

Appendix F: ETD Products Prices & Procurement Contracts

Appendix G: Checked Luggage EDS & ETD Screening Configurations

Appendix H: TSA Air Cargo Facility Regulations

Appendix I: TSA Checked Luggage Systems

Appendix J: The DOJ ETD Evaluation Protocol for 1st Responders

Appendix K: TSA Air Cargo Screening Technology List (ACSTL)

Appendix L: List of Authorized Air-Cargo on Scheduled Passenger Flights Screening Facilities

Appendix M: The Narcotics Trafficking "Industry"

Appendix N: Improvised & Military Explosives

Appendix O: Air Cargo ETD Screening

Appendix P: IATA, Boeing & ICAO Air Travel & Air Cargo Forecast to 2034

Appendix Q: IATA Airport Screening Checkpoints Recommended

Appendix R: Glossary & Abbreviations

|